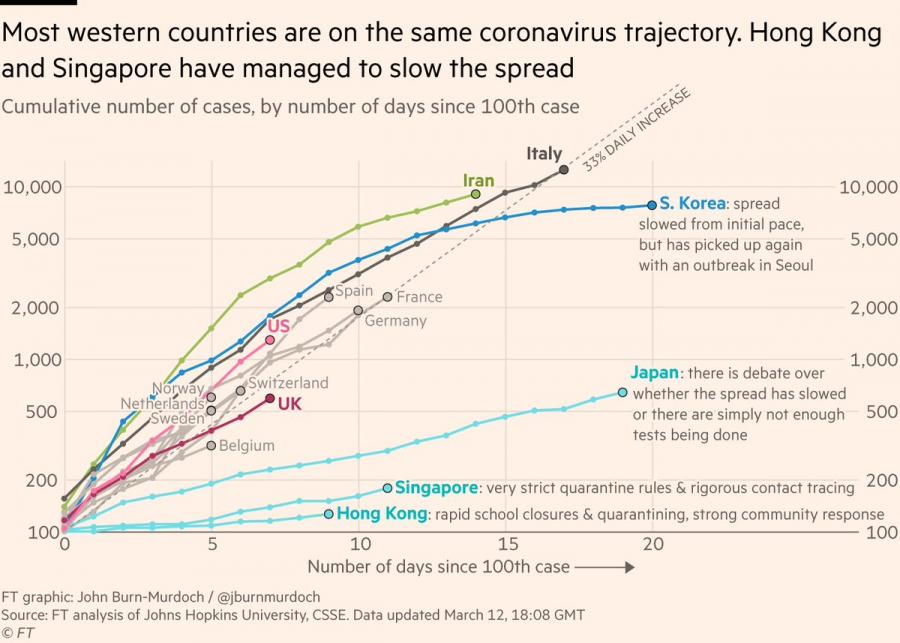

With the rise of infected patients and the spike in volatility, it’s no denying that the ongoing outbreak fuels worry. With this, many are turning to insurance companies to secure protection from catastrophic losses.

Fortunately, despite the possible risks, there are still insurance policies that cover coronavirus. Of course, while your options may not be as comprehensive as what you had before the outbreak, the remaining insurance companies still offer tons of favorable promises.

Interested to know more? Below, we have rounded up some of the best insurance companies that cover coronavirus worldwide. Check them out and compare which offer suggests the best deal.

Anthem

Anthem is one of the few businesses in the world that offer financial assistance amid the coronavirus outbreak. Specifically, as announced by the company at the end of March, it will be covering the cost of coronavirus testing for its members effective April 1st.

Under its program, Anthem will be covering the health plans of their members that are related to COVID-19 diagnosis. This includes in-person doctor office visits to telehealth consultations.

To make the program even more secure, Anthem also provides a Symptom Assessment feature. This will enable members to determine what their symptoms might indicate by answering five questions.

There is also a LiveHealth Online feature that allow clients to have 24/7 communication with a health professional via live video.

Cigna

Another major health insurer, Cigna, also comes as a reliable company that promises to waive customer cost-sharing and co-payments for all treatments related to COVID-19.

In its announcement, made just before the start of April, Cigna said its waiver of co-payments will include in-network and out-of-network medical care providers treating COVID-19 patients.

The offer, which began on March 30th, will take effect until May 31st for all Cigna customers. Similar to Anthem, the insurer also launched a 24/7 support to help people seeking help over coronavirus-related issues.

Allianz Travel Insurance

Of course, aside from health insurance companies, a few travel insurers are also offering policies that cover coronavirus. The Allianz Travel Insurance, especially, is currently accepting claims for coronavirus-related medical care and trip cancellation issues.

Under its Emergency Medical Care and Emergency Medical Transportation insurance, members can claim for coronavirus-related medical care if they get ill while on a trip.

Meanwhile, with Trip Cancellation or Trip Interruption insurance, members can cancel travel before or during their trip if they fell ill.

In addition, those who have purchased tickets to mainland China, South Korea, as well as some regions of Italy before January 22nd will have their expenses covered.

Aetna

If you’re an Aetna member and fell ill during this pandemic, you can now avail diagnostic testing related to COVID-19 without cost-sharing. Aetna announced late last month that it will be covering the cost of coronavirus hospital treatment of many Aetna policyholders.

Specifically, in accordance with the new Families First Coronavirus Response Act, the insurer now offers members a cost-sharing waiver. Among the things that will be covered are physician-ordered tests. In addition, it covers hospital visits that result in the administration of or order for a COVID-19 test.

Blue Cross Blue Shield

Last but not the least is Blue Cross Blue Shield. This is another insurer who can provide you with reliable and convenient coverage in this time of health crisis.

In March, the company announced that its network of 36 independent Blue Cross and Blue Shield (BCBS) companies will provide members with coverage of coronavirus testing. This comes along with other steps that will help boost access to coronavirus care.

Specifically, as part of its offers, BCBS will waive prior authorizations for diagnostic tests and other services. These changes follow the CDC guidance for members if diagnosed with COVID-19.

They will also boost access to prescription drugs, as well as to telehealth and other clinical support systems.

The Bottom Line

In this time of medical and economic upheaval, securing your own wellness is a top priority. Don’t let yourself become a victim of catastrophic losses. Contact the best insurer that covers coronavirus today!

![Hulugan Falls in Luisiana, Laguna [Travel Guide 2021 + Expenses & Itinerary]](https://twobudgettravelers.com/wp-content/uploads/2022/02/hulugan-falls-in-luisiana-laguna-travel-guide-2021-expenses-itinerary.jpg)