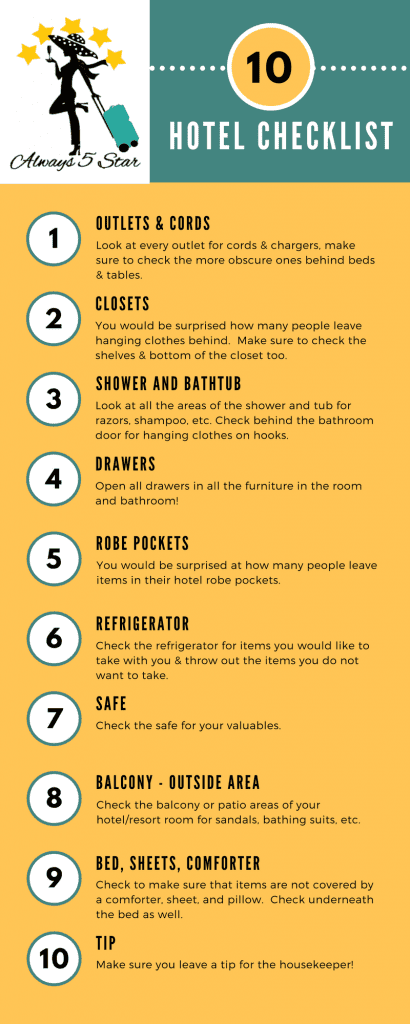

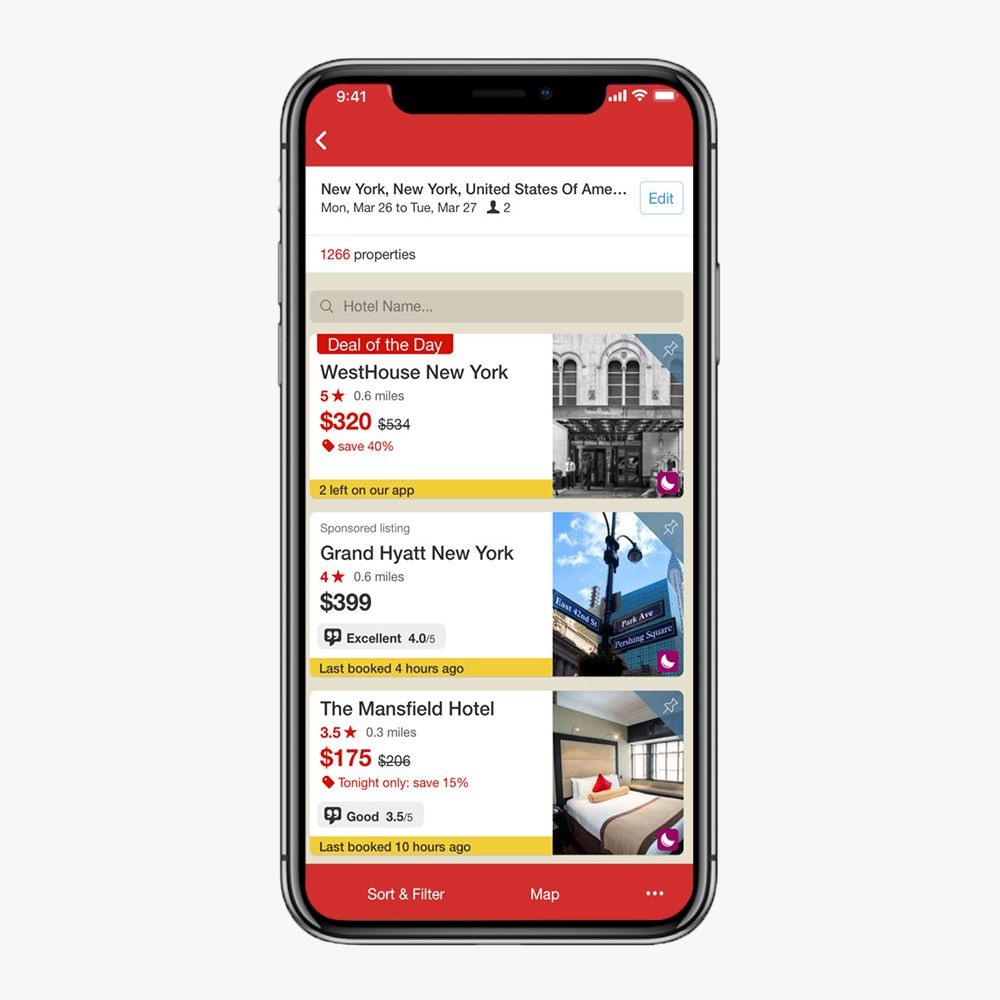

Traveling across the globe whether for leisure or for work requires a whole lot of careful preparation. From making transportation arrangements and organizing your itinerary to making sure that you bring the essential items, planning for every possibility is definitely important. That is also why it is important to make sure to get the best health insurance. Failing to adequately prepare can make or break your trip.

When traveling, one of the most important things you should make sure to have is global health coverage. After all, you never know when you will encounter a health or medical emergency. Accidents, unforeseen illnesses, and other similar instances call for worldwide health insurance.

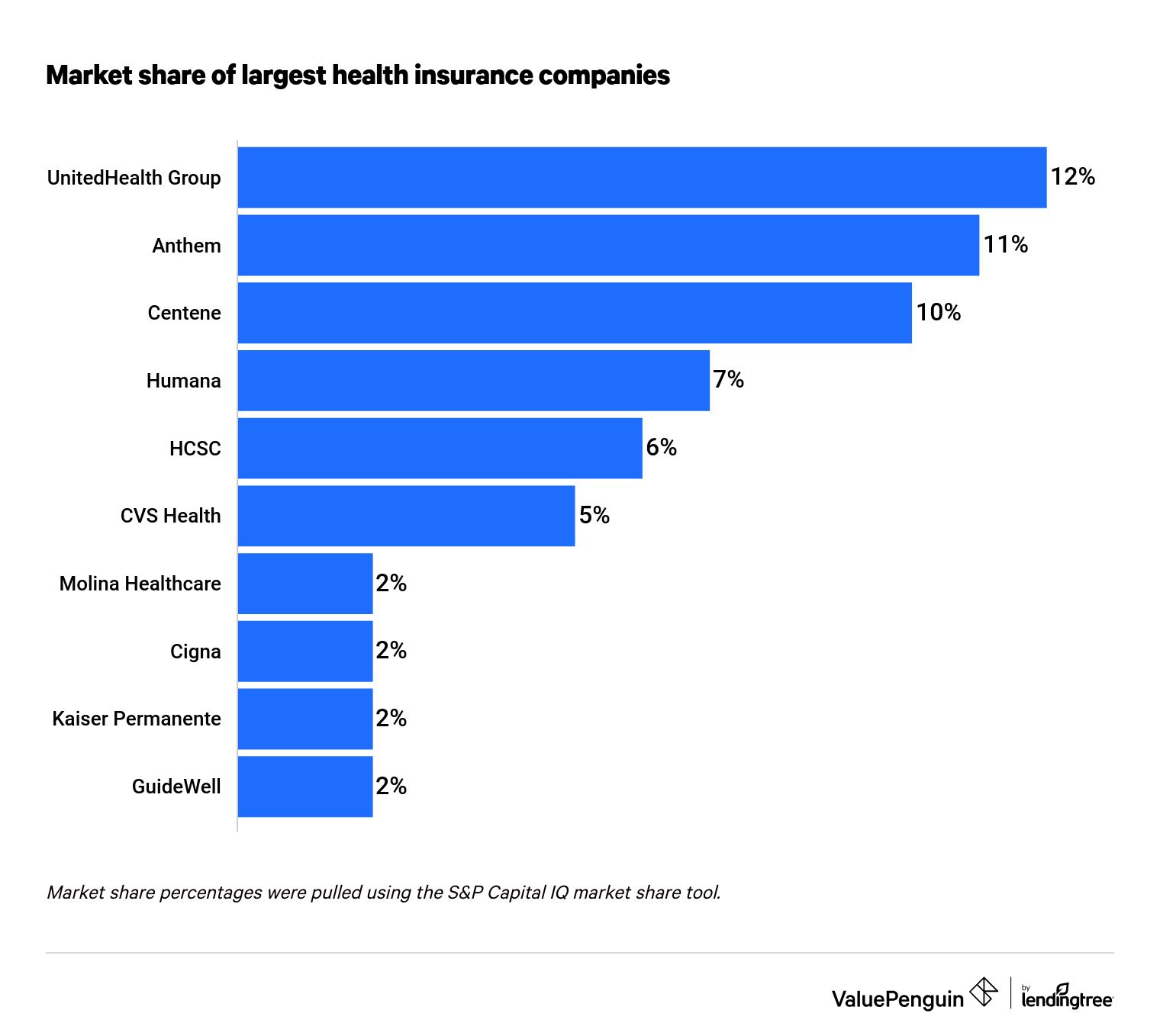

However, you want to make sure that you get insurance from a reputable and reliable company. Wondering which companies offer the best global insurance coverage? Check out the top three insurers below.

Aetna International

Aetna offers plans for individuals who reside in and outside the Americas. Its Mobile Healthcare Plan is designed for citizens of the Americas who are residing outside of the region. It comes in two varieties: the MHP Classic and MHP Exclusive. Some of the most important features of this offer include 24/7 support, emergency assistance, basic benefits, and maternity coverage.

Meanwhile, those from other parts of the world can avail of the Aetna Pioneer Plan. There is a variety of options, which can dictate how much the insured is going to pay and receive. The benefits of this plan include inpatient daycare and outpatient coverage. It also offers a variety of optional policies such as non-emergency medical evaluation, as well as routine and major restorative dental treatment.

Cigna Global Insurance

Another top insurer is Cigna Global Insurance, which offers international health insurance. This is available for all individuals including expatriates. This offer is available in different tiers namely Silver, Gold and Platinum. The standard benefits cover hospital charges for nursing, accommodation and recovery room. It also encompasses hospital charges for operations, medicine, and treatment room fees.

A great thing about Cigna’s offers is that it covers mental health care. This coverage will pay for treatments of mental health conditions and disorders. Other cases included in the policy are cancer care and parent and baby care (for Gold and Platinum only).

Customers also have the option to avail of the Global Health Assistant Program. This takes the more personalized approach, tailoring benefits and services to each individual holders’ needs.

International Medical Group, Inc.

IMG’s International Health Insurance has offers designed to cover individuals and families who want to have worldwide coverage for different reasons. Global Medical Insurance is a long-term and renewable, yet comprehensive, option that offers a variety of medical benefits. From hospital indemnity and preventative coverage to surgery and prescription medication, this policy gives holders peace of mind with medical situations when traveling abroad.

Aside from medical benefits, it also covers evacuation costs and traumatic dental injury treatments. Keep in mind that pre-existing conditions are not included in the policy. Moreover, non-emergency dental treatments also come as an option.

This company also has offerings for individuals, families, and groups who are traveling such as the Patriot Travel, Patriot America Plus, and iTravelInsured Travel Lite Insurances. Clients can get individual or group quotes, giving them cheaper options.

Bottom Line

There is nothing better than traveling knowing that you have everything you need in order. This way, you can minimize the stressful parts of your trip and maximize your leisure during your travels. With the right worldwide medical coverage from the best insurer, you can rest assured that even your health-related concerns will be covered.