Digital payments are fast becoming the new normal. And, why not? It’s far more convenient, quick, and safe to make your payments digitally. However, what if digital payments are supplemented with an efficient money management mechanism, savings, and investment?

GCash is one such amazing platform that offers you digital payment services. It’s easily one of the most unique platforms available in the Philippines.

In this article, we share a detailed overview of GCash, and also show you the step by step instructions to get started with it. Read on to learn more about this, and how you can register.

Lifestyle Services

GCash’s lifestyle category of services helps you with almost every kind of transaction that you need to make on a day to day basis. These include paying bills, booking movie tickets, and shopping online.

Further, you can also send and receive money from individuals using GCash. The app also lets you buy or borrow securely. With GCash, you can do all of these transactions with a single tap, at lightning-fast speed!

Financial Services

What sets GCash truly apart is a separate bucket of services that the app offers under the name of “Financial Services”. These services include all the banking services that an individual or business needs.

With GCash, you can transfer funds directly to and from a bank account, without the need for a separate banking app. The app also offers a GSave feature which is the digital version of a bank savings account and yields you a high rate of interest on your money.

Salient Features of GCash

Some of the salient features of the platform include the use of cutting edge and the latest payment technologies, and a widespread network of over the counter service points for physical payments.

Other features include a robust data security framework with several layers of security, and a clean and structured user interface for easy access to services.

How to Get Started with GCash

Now that you know the length and breadth of services offered by GCash in the Philippines, let us now tell you how you can get started with GCash.

Step 1

To register on the GCash platform, you need to visit the GCash website and click on the “Register” button provided on the top right corner.

Alternatively, you can also start by installing the GCash mobile app from Google Play Store(if you are an android user) or App Store (if you are an iOS user).

Step 2

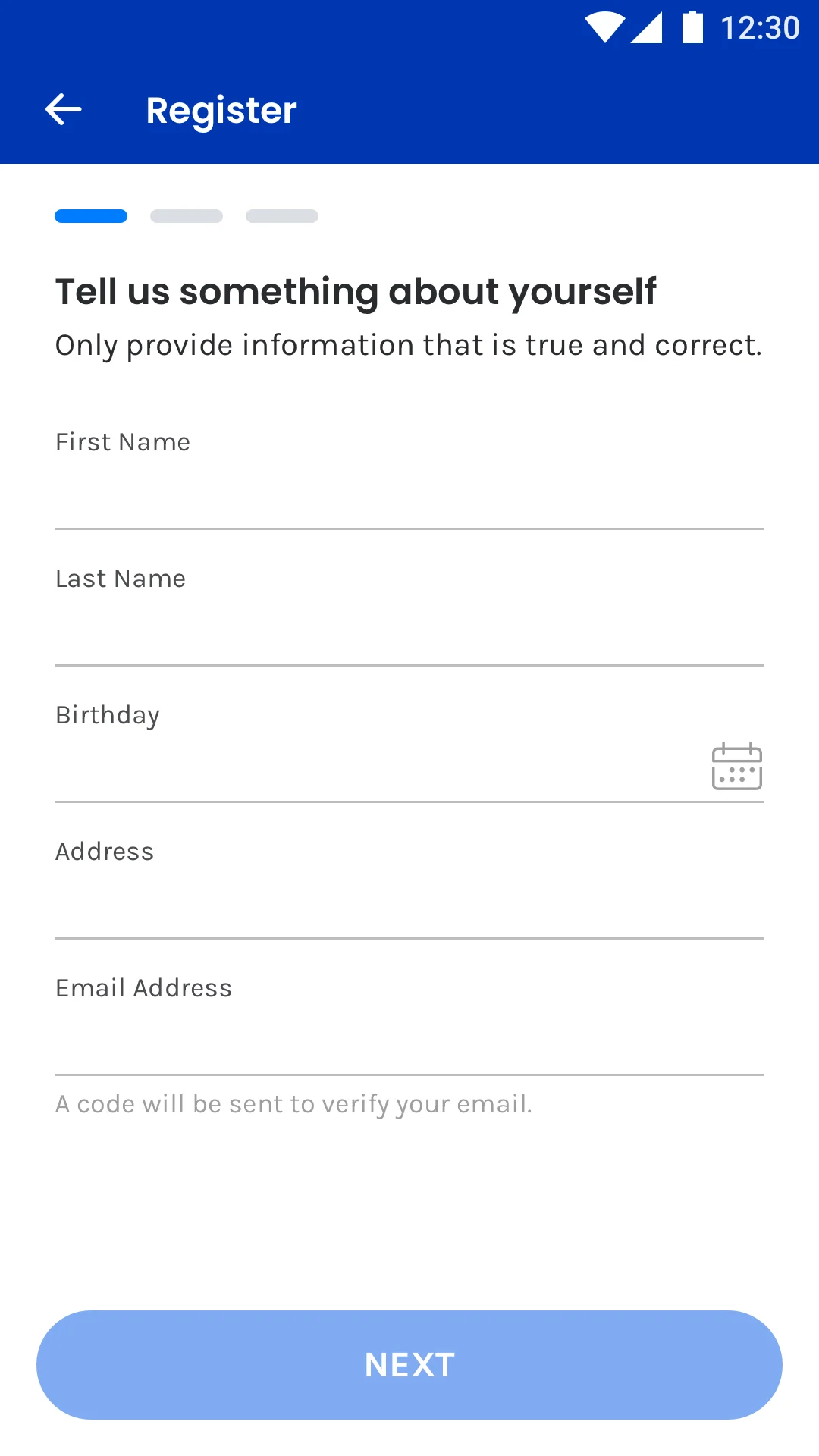

Once you are on the registration page of their website or have installed the GCash app on your mobile device, you need to provide your mobile number to proceed with the registration process.

GCash supports all networks and operators for registration on its platform. Once registered, you may need to provide some additional information to get your registration verified.

Step 3

After completing the registration and verification process, you can start exploring benefitting from the range of features offered by the platform. The first thing can be to link your bank accounts with GCash.

You can also deposit your hard cash into your GCash wallet by visiting any of the over the counter service points. Now you can purchase things, make payments, receive money, save, invest, and do much more, all with the GCash app.

Rates and Fees

In the terms and conditions of GCash, they do claim that there are fees and charges that may be applicable. Make sure to consider these rates if you are interested, and make sure to discuss these with a GCash representative before agreeing to anything.

- Cash in via bank’s mobile banking app: Php0 to Php50

- Cash in via Over-The-Counter outlets will have a fee once users exceed the monthly free limit of Php8,000: 2%

- Cash out via Over-The-Counter outlets is charged with a withdrawal fee: 2% (applies only to loaded amount beyond Php8,000 monthly)

- Cash out via ATM withdrawal fee: Php20

- Cash out via ATM Withdrawal fee (International): Php150

- GCash Mastercard Offline Card Purchase: Php150

- GCash Mastercard Online Card Purchase (Php65 delivery fee): Php215

- GCredit interest charged for the total credit purchased: 3-5%

- GCredit penalty fee: Php200 – Php1500

- Billers with fixed fees: Php0 to Php60

- Billers with percentage-based fees: 2%

- Balance Inquiry via ATM: Php3

- Balance Inquiry via ATM (International): Php50

- Dormancy fee: Php50

The Bottom Line

GCash is one of the best digital payments and cash management options that is available in the Philippines. Registering on GCash is easy, and it offers you a wide range of financial and lifestyle services on its single integrated platform with adequate safety features.

Disclaimer: Using digital payment services, like GCash, are subject to the service providers’ guidelines, terms, and conditions. Consult the terms and conditions page of the service before agreeing to anything.